In the ever-evolving world of real estate, financial reporting can be a confusing undertaking. Different Brokers, Brokerages, Real Estate consultants and accountants will have a wide variety of preferences in how accounting data is booked, displayed and reported. Worse, regulations or owners may change their preferences over time. Staying ahead of these changes can feel like a never-ending marathon, but there are internal changes you can make to navigate the external pressures you face. In this article, we will explore some best practices for real estate financial reporting that will help you streamline your processes, improve accuracy, and enhance efficiency.

Reduce Your Dependence on Excel

Excel has long been a valuable tool for accountants, offering quick and effective solutions for various tasks. However, overreliance on Excel can create risks and limitations. Excel’s single-user limitations, lack of change tracking, and time-consuming spreadsheet building processes can hinder collaboration and efficiency. Additionally, Excel lacks certain functionalities, such as file storage for financials, which necessitates the use of separate processes. To overcome these limitations, it is essential to invest in tools that streamline collaboration, meet regulatory requirements, and ensure consistency across the enterprise. By reducing your dependence on Excel and embracing more advanced technology, you can improve efficiency and accuracy in your real estate financial reporting processes.

Implement Financial Close Management Software

The financial close process is a critical aspect of real estate financial reporting. By expediting this process, you can generate financial reports more quickly and accurately. Traditionally, the financial close process has been marred by lack of communication and inefficient procedures, requiring accounting and finance teams to meet and establish each team member’s status. However, by implementing financial close management software, such as FloQast, controllers can have a centralized dashboard that provides real-time visibility into each team member’s status. This enables them to ensure all accounts are tied out and reconciliations match the trial balance amounts. By providing a single source of truth and minimizing miscommunications, financial close management software improves interdepartmental collaboration and frees up time that would otherwise be spent on status updates.

Improve Interdepartmental Communication

Effective interdepartmental communication is crucial for accurate and efficient real estate financial reporting. Each department contributes valuable components or financial data that are essential for creating the final product – the financial statements. Just like an assembly line, where each worker plays a critical part in creating the final product, every department’s contribution is vital. It is important to set clear expectations for each department, ensure they have a solid understanding of their roles, and provide them with the necessary resources to fulfill their obligations. By improving interdepartmental collaboration, you can enhance the quality and accuracy of your financial statements. Communication should not be limited to accounting standards updates but should be a proactive effort to improve overall collaboration within the organization.

Grouping and Mapping Commissions in Your Financial Statements

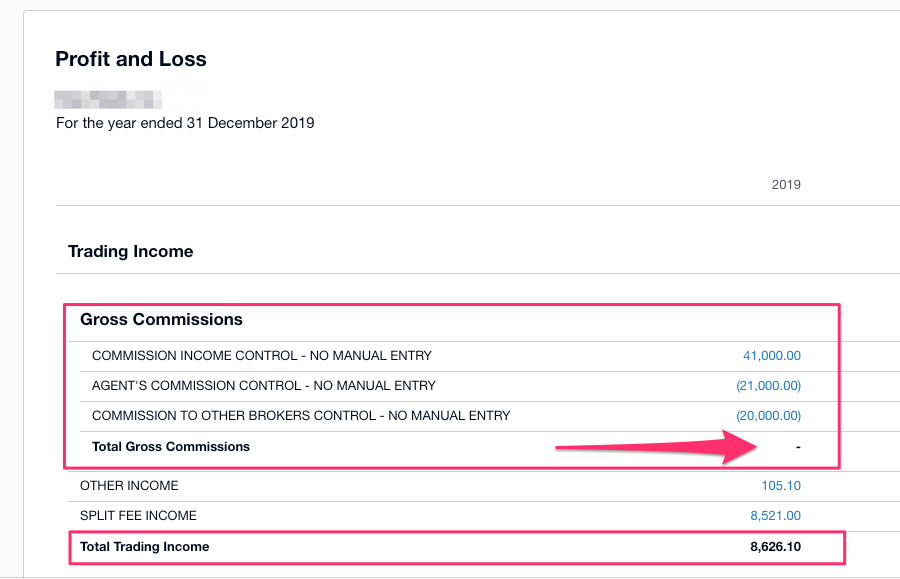

When presenting commissions in real estate financial reports, it is important to consider how they are categorized and mapped in your accounting system. This allows for a clear distinction between top-line commissions and outgoing commissions to agents and third parties. By mapping income accounts and cost of sales or expense accounts effectively, you can accurately reflect the gross commissions and brokerage income. In a standard setup, the income accounts may include “Commission Income,” representing the total commissions on deals, and “Income to the Brokerage,” representing the fees taken from agents’ commissions. On the expense side, you may have “Commissions paid to Agents” and “Commissions to outside Brokers,” if applicable. Grouping these accounts can provide a clear overview of the top-line commissions and total commission expenses in your financial statements.

Customizing Your Profit and Loss Statement

Customizing your profit and loss statement in your accounting system, such as Xero, can help you present commissions and other financial data in a way that aligns with your reporting needs. By grouping the top-line commissions separately from the costs of sales or direct costs, you can provide a more comprehensive view of your real estate financial performance. Xero allows for the customization of financial reports, making it easy to tailor the layout according to your preferences. This customization enables you to present the financial information in a clear and organized manner, ensuring that the relevant accounts are grouped appropriately. By customizing your profit and loss statement, you can enhance the clarity and effectiveness of your real estate financial reporting.

Loft47: Simplifying Commission Tracking and Accounting

Loft47 is a software platform designed to simplify commission tracking and accounting for real estate brokerages. With Loft47, you can automate entries to your accounting general ledger, eliminating the need for manual entries. The platform offers a method of commission tracking on your statement of profit and loss that has been developed in collaboration with experienced accountants. By following Loft47’s method, you can ensure the most accurate accounting of gross commission income and expenses for your brokerage. Loft47 provides you with the control to determine how entries are posted, offering a user-friendly solution that saves time and effort. With Loft47, you can streamline your commission tracking and accounting processes, enhancing efficiency and accuracy in your real estate financial reporting.

At Loft47 we share some best practices to record and display commission income and expenses that make the distinction between Gross Commissions earned by the Agents and income earned by the Brokerage obvious.

In these two examples, the total commissions flowing in and out of the Brokerage are clearly accounted for while simultaneously highlighting the actual income earned by the Brokerage.

Conclusion

Keeping up with the ever-changing landscape of real estate financial reporting can be challenging. However, by implementing best practices and leveraging technology, you can streamline your processes, improve accuracy, and enhance efficiency. Reducing your dependence on Excel, implementing financial close management software, improving interdepartmental communication, and investing in commission accounting software are key steps towards achieving these goals. Additionally, properly grouping and mapping commissions in your financial statements, customizing your profit and loss statement, and utilizing software solutions like Loft47 can further simplify and optimize your real estate financial reporting. By following these best practices, you can navigate the complexities of real estate financial reporting with confidence, ensuring accurate and reliable financial statements for your brokerage.